Indirect Tax Consultancy

VARIOUS FREE TRADE AGREEMENT CONSULTANCY

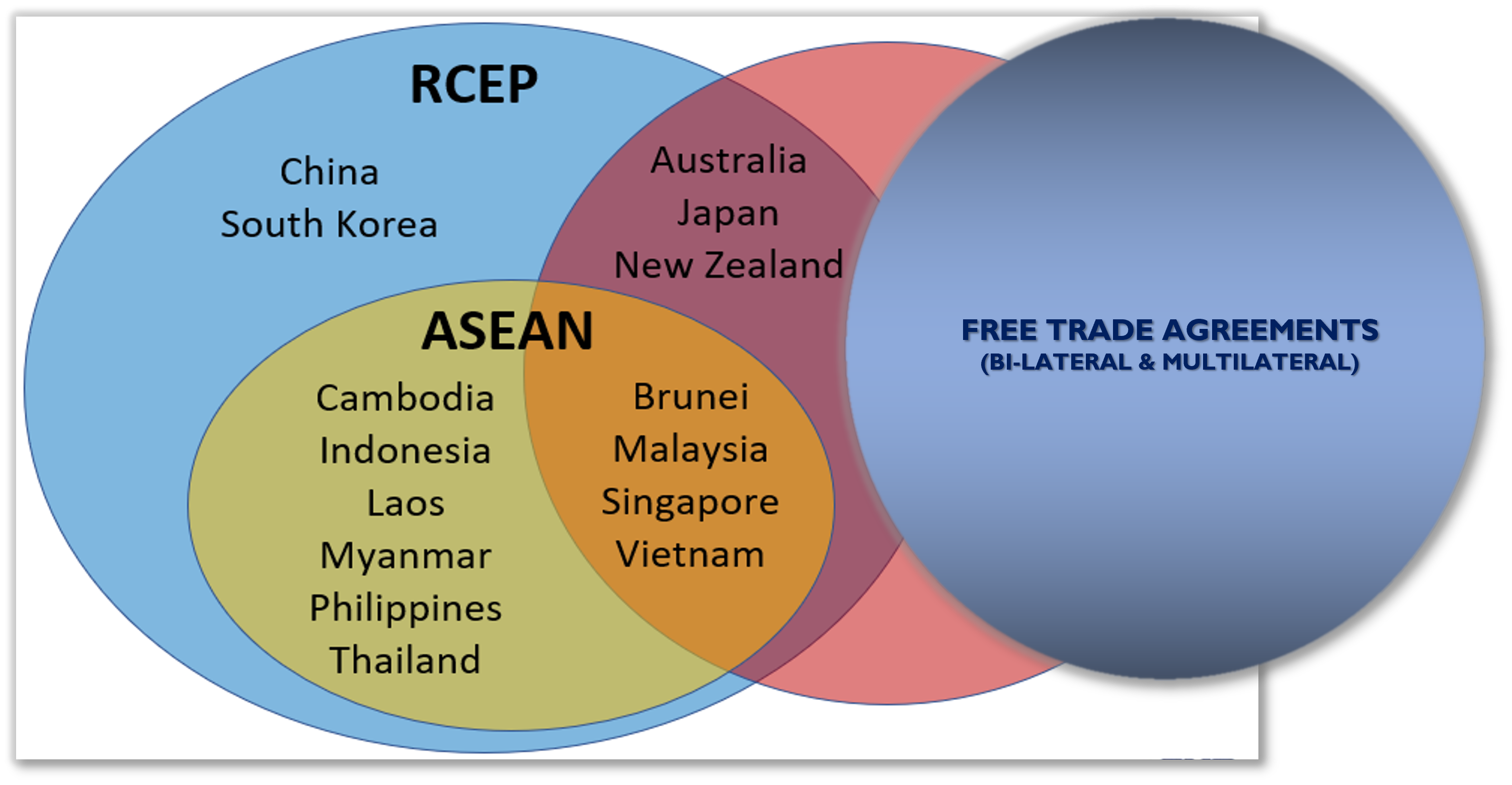

FTA is an agreement made between two or more countries under which countries involved are given preferential market access. Import Duties varies from 0% to 60%. An importer would need to apply for Preferential Certificate of Origin (CO) which is a certificate/trade document issued by a competent authority of the exporting country that certifies the origin of the goods, which allows importer to claim for preferential tariff rates based on Rules of Origin of each agreement entered into force. Thus far, there are 9 multilateral and 7 bilateral FTAs enforced in Malaysia.

Trans International Logistiks Sdn.Bhd

Contact Info (HQ)

Address | : Lot 6-3, Jalan SS7/16, Kelana Jaya, 47301 Petaling Jaya, Selangor Darul Ehsan, Malaysia. |

Phone | : +603-7873 1333 |

Fax | : +603-7873 3331 |

: inquiry@tilogistiks.com |

Contact Info (KLIA Office)

Address | : Lot C-12, MAS Freight Forwarders Building FCZ, KLIA Cargo Village 64000, KLIA Sepang, Selangor Darul Ehsan, Malaysia. |

Phone | : +603-8787 8648 |

Fax | : +603-8787 1773 |